Supplier Relationship Management means different things to different people.

Some organisations see SRM as purely administrative. Others claim to pursue strategic supplier relationships that drive top-line growth. Most fall somewhere in between these extremes.

The reality is messy.

- Your finance team talks about contract compliance.

- Your operations team focuses on quality audits.

- Your sustainability lead wants supply chain transparency.

Everyone uses the same acronym but means something entirely different.

This ambiguity creates problems. When we’re unclear about what SRM actually means, we end up with the wrong software, misaligned teams, and frustrated stakeholders.

Let’s clear up the confusion.

What SRM means across different industries

The scope of SRM varies wildly depending on your sector and organisational priorities.

For compliance-focused organisations and regulated industries, SRM centres on “Know Your Supplier” requirements. Due diligence becomes paramount. Onboarding processes must be watertight. Corporate social responsibility reporting drives supplier selection.

Consumer goods and fashion brands prioritise brand protection. Supply chain scandals can destroy decades of brand equity overnight. These organisations focus on responsible sourcing of raw materials and preventing labour rights violations.

Automotive and manufacturing companies take a different approach. They obsess over supply chain risk and security of supply. Quality audits matter more than corporate responsibility statements. Production delays cost millions, so supplier performance tracking becomes critical.

Almost everyone needs spend analytics and contract management. Understanding what you spend and who you spend it with forms the foundation of any SRM program.

The problem is obvious. We use one term to describe vastly different activities and priorities.

Is SRM even the right term?

The term “Supplier Relationship Management” creates unrealistic expectations.

What most organisations actually need is Vendor Lifecycle Management or Supplier Lifecycle Management. This more accurately describes the end-to-end journey of managing suppliers from initial contact through to off-boarding.

The vendor lifecycle includes five distinct phases

- Onboarding gets new suppliers set up in your systems. This involves data collection, compliance checks, and system access provisioning.

- Sourcing identifies the right suppliers for specific needs. Competitive processes ensure you’re getting market-appropriate pricing and terms.

- Contracting establishes formal relationships with agreed terms. Legal teams draft contracts whilst procurement negotiates commercial terms.

- Performance management tracks ongoing supplier delivery. Continuous improvement programmes drive better outcomes over time.

- Post-signature contract lifecycle management maintains the relationship after ink dries. Obligations get monitored, renewals get planned, and exit strategies get developed when needed.

Calling all of this “relationship management” oversimplifies reality. Most of these activities are operational and administrative, not relational.

True relationship management only happens at the strategic level with key suppliers.

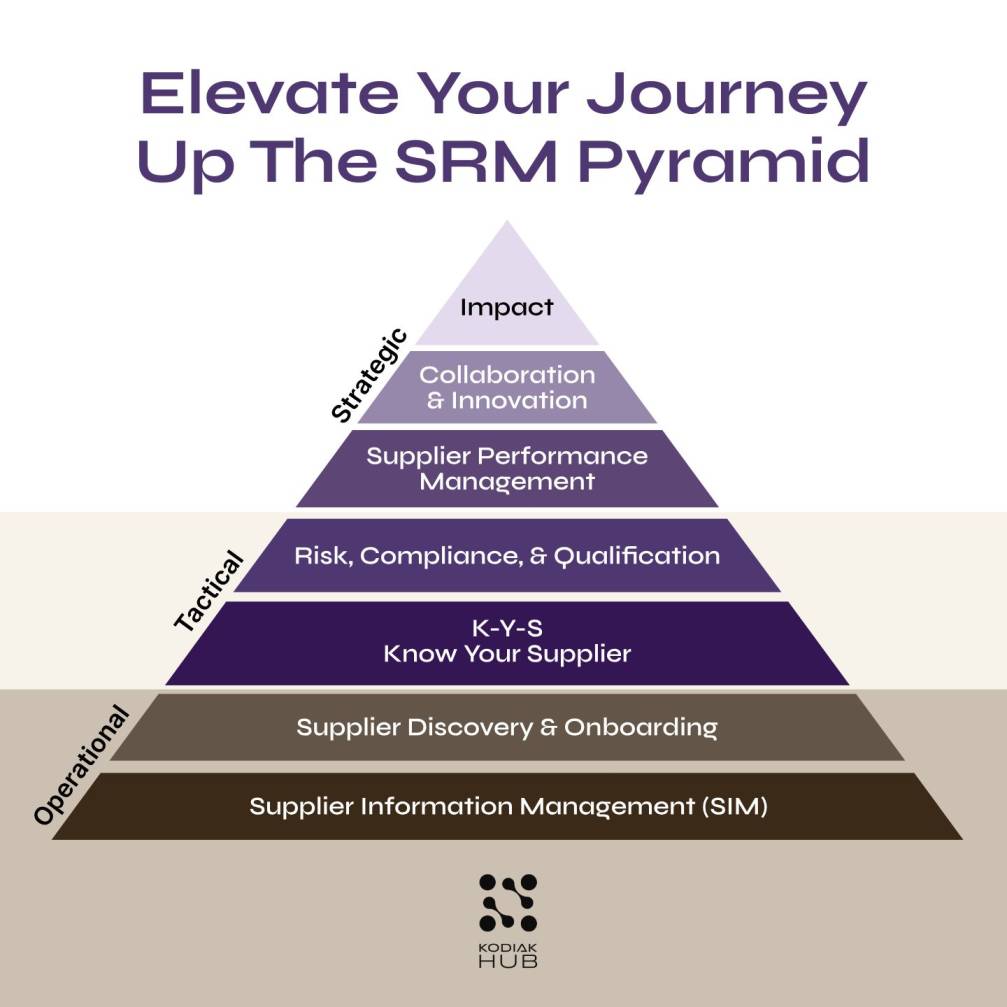

Administrative Supplier Management

Let’s start with the basics. Administrative supplier management focuses on getting suppliers into your systems and keeping their information current.

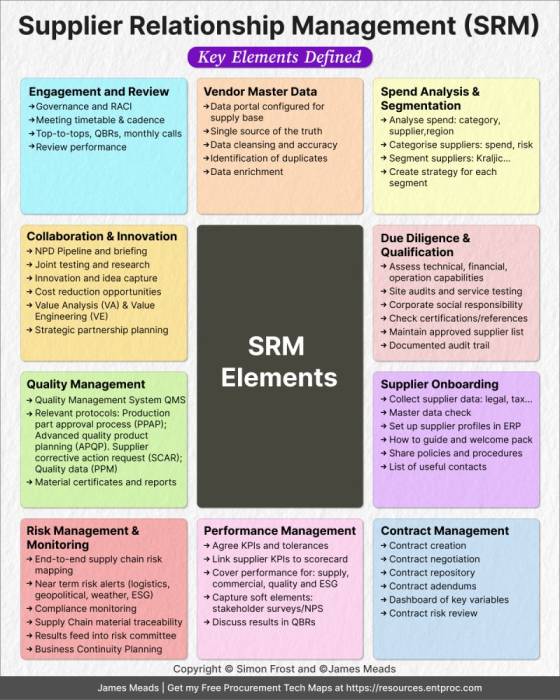

Due diligence and qualification

Before you can work with a supplier, you need to know they’re legitimate and capable. Due diligence processes verify company registration, financial stability, and relevant certifications.

For regulated industries, this extends to detailed compliance checks.

The administrative burden here is significant. Most organisations still rely on email questionnaires and spreadsheet tracking. Suppliers hate it. Procurement teams spend countless hours chasing responses.

Onboarding

Once qualified, suppliers need setting up with vendor master data, payment terms, and perhaps system access.

Getting supplier information wrong creates downstream problems. Duplicate vendor records lead to split spend and lost volume discounts. Incorrect payment terms cause reconciliation headaches.

Traditional onboarding can takes weeks or even months. Procurement sends forms to suppliers. Suppliers fill them out incorrectly. Finance rejects the submission. The cycle repeats.

Modern supplier portals reduce this friction dramatically. Suppliers self-serve their information. Validation rules catch errors immediately. Approval workflows route to the right people automatically.

Contract management (pre-signature)

Administrative contract management covers everything before the contract gets signed. This includes drafting agreements, negotiating terms, and managing approvals.

Many organisations separate this from ongoing contract management. Better approaches integrate contracting with lifecycle management. But we’ll come back to that.

Operational and Tactical Supplier Management

Moving beyond administration, operational supplier management focuses on keeping suppliers performing and compliant.

Quality management

Manufacturing organisations live and die by supplier quality. Defective components cause production delays, warranty claims, and brand damage.

Quality management systems track supplier performance against specifications. Inspection processes catch problems before they reach your production line. Corrective action requests drive improvements when issues arise.

Technology helps here. Supplier portals enable real-time quality reporting. Automated alerts flag emerging problems. Analytics identify patterns across multiple suppliers.

Performance management

Beyond quality, suppliers need to deliver on time, in full, and at the right price. Performance management tracks these metrics and drives continuous improvement.

Traditional approaches use quarterly business reviews and spreadsheet scorecards.

Modern performance management happens in real-time. Dashboards provide live visibility into delivery performance. Automated alerts flag potential problems before they become critical.

The goal is prevention, not just measurement. Soft KPIs, such as stakeholder surveys, are often just as important as hard KPIs too.

Vendor master data enrichment and harmonisation

Your ERP contains thousands of supplier records. Most organisations have duplicate entries, inconsistent naming, and incomplete information.

This data quality problem undermines spend analytics and category management. You can’t consolidate suppliers if you don’t know you’re using the same company three times under different names.

Data enrichment programs clean up vendor master data. Duplicate records get merged. Missing information gets filled in. Inconsistent naming gets standardised.

This unglamorous work delivers significant value. Better data enables better decisions about supplier consolidation, volume discounts, and category strategies.

Risk management and monitoring

Supply chain disruptions cost billions annually. Supplier financial distress, geopolitical instability, and natural disasters all threaten continuity of supply.

Risk management programs identify vulnerable suppliers before problems materialise. Financial health monitoring spots warning signs. Geographic concentration analysis reveals single points of failure.

Some organisations also use technology to monitor news and social media for emerging risks. Advanced solutions use AI to process thousands of data sources and flag potential issues.

The key is early warning.

Strategic Supplier Management

Strategic supplier relationship management is what everyone claims they want to do, but few organisations actually do it well.

Engagement and review

Strategic supplier relationships require regular, meaningful engagement. Not just quarterly business reviews (QBRs) that rehash performance metrics everyone already knows.

Real engagement means joint planning sessions, innovation workshops, top-to-top meetings, and executive sponsorship. Both organisations invest time and resources into developing and nurturing the relationship.

Strategic review processes look beyond operational metrics. They explore market trends, capability development, and mutual growth opportunities. The conversation shifts from “what went wrong last quarter” to “how can we win together.”

Most organisations lack the bandwidth for strategic engagement across their entire supply base. Segmentation becomes essential. Focus strategic effort on suppliers who can truly differentiate your business.

Spend analysis and segmentation

You can’t manage strategically without understanding your spend patterns.

Supplier segmentation categorises your supply base by strategic importance. The Kraljic matrix remains popular for this, though many organisations develop custom segmentation models.

- Strategic suppliers get intensive relationship management.

- Tactical suppliers get efficient processes.

- Transactional suppliers get automation wherever possible.

Without proper segmentation, you risk treating all suppliers the same. Strategic suppliers don’t get the attention they deserve, while small, transactional suppliers consume disproportionate resources.

Collaboration and innovation

The holy grail of strategic supplier management is joint innovation. Suppliers bring market knowledge, technical expertise, and R&D capabilities that internal teams lack.

Collaborative innovation programs identify opportunities for mutual value creation. This might mean co-developing new products, improving processes, or reducing total cost of ownership.

Smart organisations tap into supplier R&D investments without bearing the full cost themselves. Suppliers developing solutions for multiple customers can offer innovations at lower prices than internal development.

Innovation requires trust and transparency. Suppliers won’t share intellectual property with customers who just beat them up on price every renewal. Strategic relationships enable breakthrough innovations that transactional relationships cannot deliver.

Are we clear what we mean by SRM?

Probably not. And that’s a problem.

When procurement talks about SRM to business stakeholders, what do they hear? If we’re referring to administrative supplier onboarding and driving tactical cost savings, but stakeholders think we mean strategic innovation partnerships, then we’ve got a communication problem.

The term “Supplier Relationship Management” sets expectations we often can’t meet. Most of what we call SRM is actually operational management, not relationship building.

We need clearer language. Supplier Lifecycle Management better describes the full scope of activities. Strategic Supplier Engagement more accurately captures what happens with key partners.

Using precise terminology helps stakeholders understand what procurement actually does. It also helps us be honest about where we spend our time.

If you’re spending 80% of your time on administrative onboarding and 20% on strategic relationships, be honest and call it what it is. Processing due diligence questionnaires doesn’t constitute strategic supplier relationship management.

Clarity enables better resource allocation. If strategic relationships drive competitive advantage, then we should spend more time on them.

The graphic below from our friends at SRM platform Kodiak Hub captures this perfectly.

The tech landscape for SRM software is very diverse

This brings us to technology. And here’s where the confusion really causes problems.

Whenever someone asks me “can you recommend an SRM software,” I usually ask them the Spice Girls question.

So, tell me what you really, really want!

Vagueness about SRM requirements leads you down frustrating paths when searching for software. The market is incredibly diverse, with solutions specialising in different aspects of supplier management.

Different tools for different needs

Some platforms focus on supplier onboarding and data management. They excel at the more administrative side, such as:

- Collecting information;

- Managing compliance documents;

- Maintaining clean vendor master data.

Other solutions specialise in supplier performance management.

- They track KPIs;

- Manage scorecards;

- Drive continuous improvement programs.

Contract lifecycle management platforms handle pre-signature contracting. They provide:

- Clause libraries and in-app redlining;

- Approval workflows;

- Obligation tracking.

Risk management solutions monitor

- Financial health;

- Regulatory compliance;

- Potential supply chain disruptions.

They aggregate data from multiple sources and flag emerging issues.

Innovation management platforms facilitate collaboration on joint development programmes.

- They track ideas;

- Manage pilots

- Measure ROI from supplier innovations.

No single platform does all of this brilliantly. The market is too fragmented, and customer needs are too diverse.

Defining your requirements

Before you start searching for SRM software, get crystal clear about what you actually need.

Are you trying to automate supplier onboarding?

- Look for platforms with strong data collection and compliance management capabilities.

Do you need better visibility into supplier performance?

- Focus on solutions with robust analytics and real-time monitoring.

Want to drive innovation with strategic suppliers?

- Prioritise collaboration tools and idea management functionality.

Trying to reduce contract risk?

- Emphasise contract lifecycle management with strong obligation tracking.

The more specific you are about requirements, the better your software selection will be.

Generic RFPs produce generic responses that don’t help you choose. The Request for Solution (RFS) approach is often better when requirements are not crystal clear. Let procurement software suppliers show you what their tool can do, and what’s in their tech roadmap.

Getting help with your search

If you’re overwhelmed by the options, that’s understandable. The procurement technology landscape contains hundreds of solutions claiming to do SRM.

We can help you navigate this complexity. Our RFI-as-a-Service provides detailed shortlists of solutions that meet your specific needs.

We start by understanding your actual requirements, not generic SRM buzzwords. We then match you with vendors whose capabilities align with your priorities.

This saves months of research time and helps you avoid expensive mistakes.

Reach out to us if you want a detailed shortlist of solutions that actually meet your needs. We’ll cut through the marketing fluff and focus on what matters for your organisation.